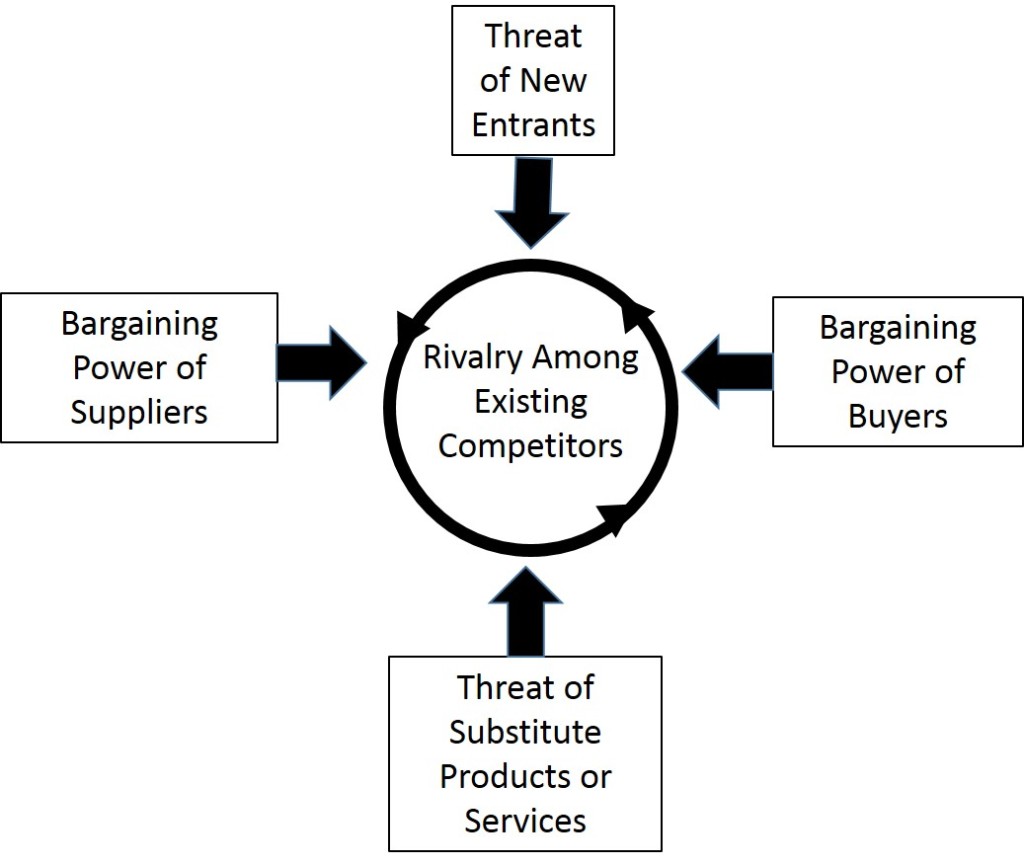

Definition: Porter’s five forces model, refers to a

framework based on the competitive analysis, introduced by Harvard Business

School Prof. Michael E. Porter. The model determines the intensity of

competition in any industry is a mix of five competitive factors operating in

different areas of the whole market.

The framework is an outside-in strategy tool for the

business unit that evaluates the attractiveness (profitability) of an industry.

Thus, helps the business-persons to identify existing and potential lines of

business.

It is a useful tool for accurately diagnosing important

competitive elements in the market, as well as determining the strength and

significance of each five forces.

Threat Of New Entrants: Potential entrant is the

major source of competition in the industry. The product range, quality,

capacity, etc. brought by them, increases competition. The size of the new

entrant plays a major role here, i.e. the bigger the entrant, the more intense

is the competition. Moreover, the prices are slashed, and the overall

profitability of existing players is also affected, by the new entry.

It analyses the ease of entry to the new market, i.e. if

the entry is easy, then the level of competition in the industry is severe.

Bargaining Power Of

Suppliers:

Suppliers, also exert substantial bargaining power over the firms, by

threatening to increase prices or degrade quality. They are likely to exercise

power if:

§ The number of suppliers in

the industry is limited in number.

§ They offer the specialized

product.

§ The supplier’s product is

an important input, to the buyer’s product.

§ The product has a few

substitutes.

Thus, the factor analyses bargaining power of industry

suppliers, which directly affects the profitability, i.e. the higher the cost,

the lesser is the profitability.

Bargaining Power Of

Customers:

The market of outputs, i.e. the customers have the ability to compete with the

supplying industry and put the companies under pressure, by forming groups or

cartels. This force not only affects the prices but also influences the

producer’s cost and investments in certain circumstances, as the powerful

buyers influence producers to offer better quality which involves cost and

investment.

Buyer groups are likely to exercise power if, they are

concentrated, products are homogeneous, the switching cost is low, and full

information is available.

Threat From Substitutes: It is the quiescent source

of competition, present in the industry. They are the key cause of competition

in many industries. Substitute products are offered at reasonable prices along

with high quality, to the customers can radically change the competitive

scenario of industry, especially, when the introduction is sudden.

Rivalry among current

players:

Last but not the least, is the rivalry among current players, which is all that

is known as competition. It can be shown in a number of ways such as:

§ Price competition

§ Advertising battles

§ New introductions

§ Improving quality

§ Increasing consumer

warranties.

So, this factor analyses, how ruthless the competition

is, by identifying the existing player and marketing down their moves and

activities. The competition is said to be acute when, there are a few sellers,

offering similar products to the customers because it is easy for buyers to

switch to the one offering product at low prices.

Therefore, the model is all about taking offensive and

defensive actions, to create and maintain a competitive position in the market

and to cope with the challenges (five forces) successfully.

No comments:

Post a Comment